NYT Article Likens Tribune's Zell Era to Animal House

By Chuck Sudo in News on Oct 6, 2010 4:30PM

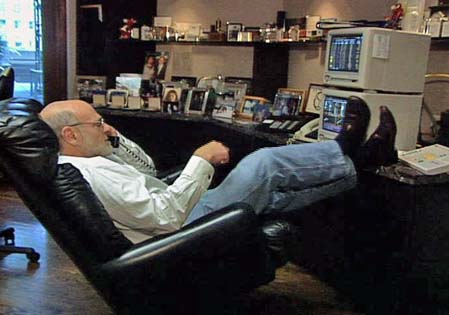

Today's New York Times has a pull-no-punches, just-the-facts expose on Sam Zell's disastrous ownership of Tribune Co. The article posits that, as gross of a miscalculation the heavy borrowing Zell used to broker the purchase was, the decision to bring in a group of aging frat house types led by current CEO Randy Michaels to steer the company into a new era of workplace blunt talk may have been even more damaging to the company, from the perspectives of both business and morale. Comparing what Zell, Michaels and their lieutenants have done since arriving to Nero fiddling while Rome burned is not out of line.

The Times' David Carr crafts a culture clash between the proud newspaper staff struggling to maintain the standards of the paper and the oafish, oversexed group of radio execs brought in by Zell to energize the troops but wound up giving most of them shellshock. None come off as more boorish than Michaels, who is said in the piece to have offered $100 to a waitress to flash her breasts with other Trib executives witnessing (a claim Michaels has long denied); announced the hiring of a senior sales executive by listing one of her former jobs as "a former waitress at (the ficitonal) Knockers — the Place for Hot Racks and Cold Brews;" and the infamous poker party in the office of Tribune founder Col. Robert McCormick that Robert Feder broke months ago.

Zell comes across in the article as a more base version of former Sun-Times owner Conrad Black. Having invested only $315 million of his own money in the $8 billion purchase of tribune Co., Zell told shareholder employees in a memo, “I’ve said repeatedly that no matter what happens in this transaction, my lifestyle won’t change. Yours, on the other hand, could change dramatically if we get this right.”

With $7.6 billion in assets against a debt of $13 billion leading to the largest bankruptcy in American history and more than 4,200 jobs cut from the company, it might be safe to assume Zell didn't get it right.