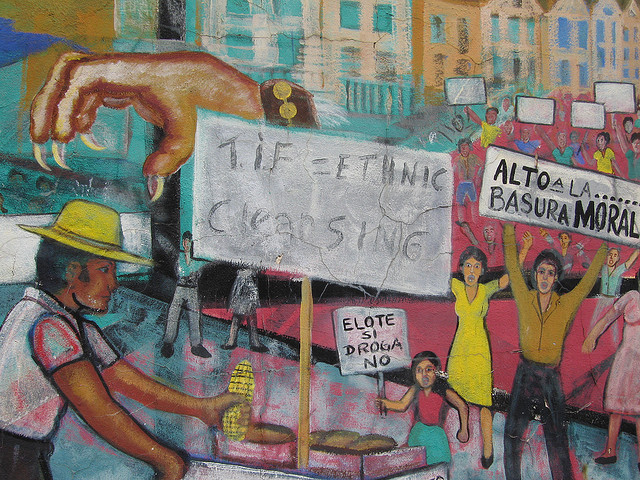

TIF Funding Continues To Decline

By aaroncynic in News on Jul 27, 2012 7:00PM

Tax Increment Financing funding in Chicago and the suburban areas of Cook County continues on its downward spiral, with 80 percent of Chicago TIF districts showing revenue drops in the double digits. According to a report released by Cook County Clerk David Orr on Wednesday, the 443 active TIF districts in Cook County collected under $729 million in 2011, a ten percent decline from $809 million in 2010. Since their peak in 2007, TIF revenues have dropped a total of 18 percent.

Tax Increment Financing funding in Chicago and the suburban areas of Cook County continues on its downward spiral, with 80 percent of Chicago TIF districts showing revenue drops in the double digits. According to a report released by Cook County Clerk David Orr on Wednesday, the 443 active TIF districts in Cook County collected under $729 million in 2011, a ten percent decline from $809 million in 2010. Since their peak in 2007, TIF revenues have dropped a total of 18 percent.

While 18 TIFs increased countywide, nine of them generated zero revenue in 2011, including one of the top five revenue generating disctricts, the LaSalle Central, which brought in $20 million two years ago. All but one of the new TIF's created were in the suburbs.

County Clerk David Orr said in a release, “These dramatic declines raise critical questions. What are the legal and financial implications of falling revenue on TIF obligations for bonds or other developmental commitments like the River Point development in the LaSalle Central TIF? How will revenue declines affect adjoining TIFs?”

Orr's report blames declining real estate values, “which yielded lower assessments that impacted the incremental value.” About 12 percent of Cook County properties are located in a TIF district.

The County Clerk called for a moratorium during the waning months of the Daley administration so incoming Mayor Rahm Emanuel could develop new policies. At the time Orr and others were concerned over the majority of the subsidies going to already well-off neighborhoods like the Loop and a lack of transparency. A four-month investigation by Columbia College journalism students last year showed that less than half of TIF funds went to underdeveloped communities.

The Emanuel Administration's panel on TIFs proposed a set of metrics evaluated by the City Council and Economic Development team to decide on the continuation or reevaluation of a TIF. “Anyone who reads the paper knows that TIFs are still controversial. But that may be necessary. Any significant government policy should be discussed by all interested parties in the light of day, rather than behind closed doors,” said Orr.