Property Tax Bills Will Rise; Show TIF Diversions

By Chuck Sudo in News on Jun 23, 2014 1:45PM

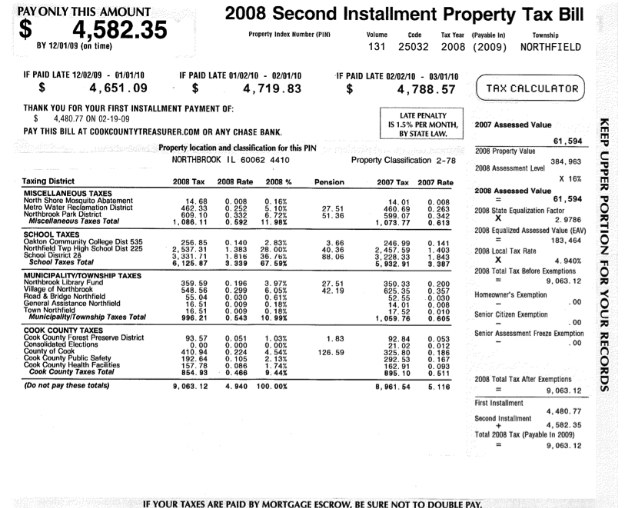

Cook County second installment tax bills will be mailed out this week and there will be a bit of sticker shock for homeowners. According to County Clerk David Orr, Chicago homeowners should expect to see an average increase in their property taxes of 1.3 percent, which Orr says mostly comes from the tax levy implemented by the Chicago Board of Education to help balance last year’s Chicago Public Schools budget. The Chicago Park District and Metropolitan Water Reclamation District also increased their levies last year.

The increases in the property tax bills will vary by homeowner but are expected to range from less than 1 percent to over 2 percent. Another change in the bills homeowners will notice once they’re sent out will be, for the first time, seeing the exact amount of tax money being diverted to tax increment financing (TIF) districts. Last year’s tax bills had a line item showing a homeowner lived in a TIF district but referred them online to see the actual amount that was diverted.

Nearly 12 percent of Cook County homeowners live in TIF districts. Orr’s office estimates the overall revenue to be collected by the country’s myriad taxing agencies will increase to $12.1 billion, or 1 percent.