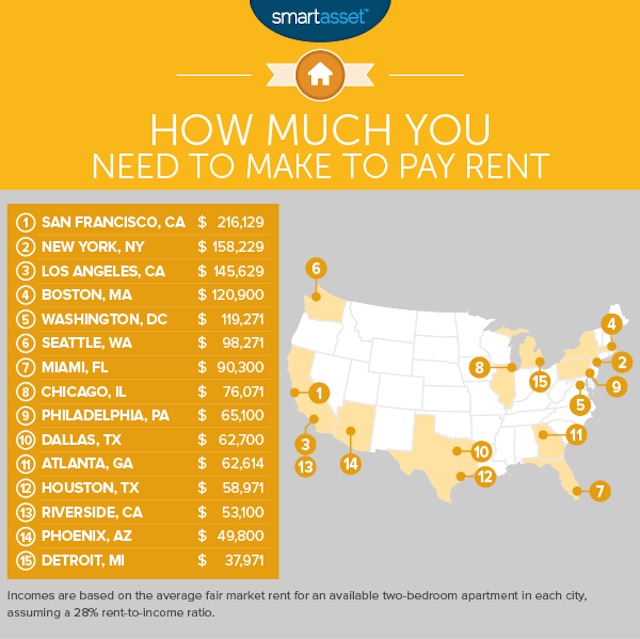

Chicago Households Need To Make $76K A Year To Afford Their Rent, Study Finds

By Stephen Gossett in News on May 19, 2016 3:05PM

Chicago households need to make more than $76,000 a year to afford average rent on a two-bedroom apartment, according to a study by personal finance company SmartAsset. Among cities examined, Chicago ($76,071) placed eighth highest overall in the country, still well behind leaders San Francisco ($216,129) and New York City ($158,229)—both of which require more than double the income Chicago does.

In their analysis, SmartAsset defined affording an apartment as spending 28 percent or less of your income on rent. They chose this percentage based on the Department of Housing and Urban Development's definition of affordable housing, which requires a household to spend no more than 30 percent of income on rent and utilities. In order to gauge rental rates, the SmartAsset focused on April 2016 rents in the primary cities in the country's 15 largest Metro areas.

Chicago's income threshold rose 1.7% from last year, as did market rents in the city—a surprisingly modest increase. Of the cities analyzed that did see rents rise, Chicago's jump was smallest, perhaps because apartments in the transit-oriented developments (TODs) popping up across the city haven't hit the market yet. (Rent didn't rise in every city, though: New York, Boston and Philadelphia all saw minor decreases.)

That may all seem like cold comfort, as a $75,000 baseline still sounds pretty steep. Is it just us, or do you hear the familiar sound of “Move to Detroit” trend pieces being written anew?

[h/t Curbed]