Boeing Pays Just 0.1% Of Its Profits To Illinois In Taxes

By Emma G. Gallegos in News on Apr 28, 2017 6:00PM

A new study reveals that profitable corporations—many extremely profitable—have been paying fewer and fewer state taxes around the country, all while corporate profits soar. In Illinois, a state that has been suffering from a budget impasse for nearly two years, some companies pay next to nothing for the privilege of doing business in the state.

The Institute on Economic Taxation and State Policy released a report that looks at how much profitable Fortune 500 pay in taxes, including state and federal taxes. The group looked at 258 companies specifically who suffered no losses from 2008 to 2015—in other words the most consistently profitable companies. Though companies are supposed to pay a 35% federal income tax, as a whole these profitable companies paid 21.2% thanks to loopholes and deductions.

It's even worse at the state level. The report breaks down just how much (or little) these major corporations pay in each state. States have been racing to the bottom to try to attract corporations to their state, and as a result businesses are paying fewer taxes in states during a time of record corporate profits. On average, the state corporate tax rate is 6.25%, but these profitable companies paid just 2.9% of their profits. From 1986 to 2013, state and local corporate tax rates declined 30%, the report says. And yet states continue to compete with one another to offer tax giveaways to corporations.

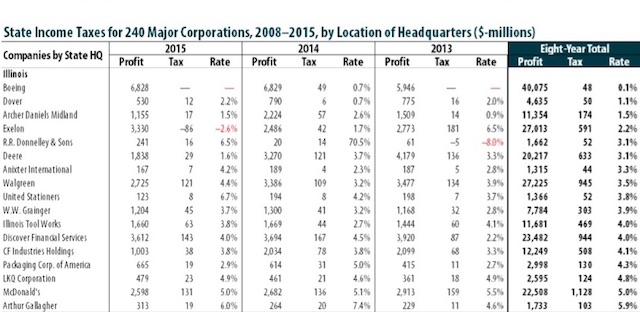

The report looks into 17 companies headquartered in Illinois and finds that some of the biggest companies are paying very little. Take Boeing, which has earned over $40 billion in profits during the period studied—and only paid 0.1% of that to Illinois. This comes at a time that some of the most vulnerable in the state—people with disabilities, the homelessness, opioid addicts, rape victims, low-income seniors—are watching their safety net being slashed. (And in the meantime, Illinois homeowners are paying higher property rates than anyone except New Jersey homeowners.)

We should maybe stop pretending IL is a miserable place for businesses and talk about how tough it is for social service agencies. https://t.co/zJIjxF5Jeo

— Scott Smith (@ourmaninchicago) April 28, 2017

You can see just how much Illinois' most profitable corporations are paying in this graph created by The Institute on Economic Taxation and State Policy:

Illinois corporate tax rate by company (The Institute on Economic Taxation and State Policy)

Taxes have been in the national news a lot lately, thanks to President Trump failing to show his tax returns while stumping for a reform effort that many say amounts to a giveaway for the extremely wealthy.