Among Major Cities, Chicago Ranks Worst In Home Value Recovery

By Stephen Gossett in News on May 3, 2017 9:26PM

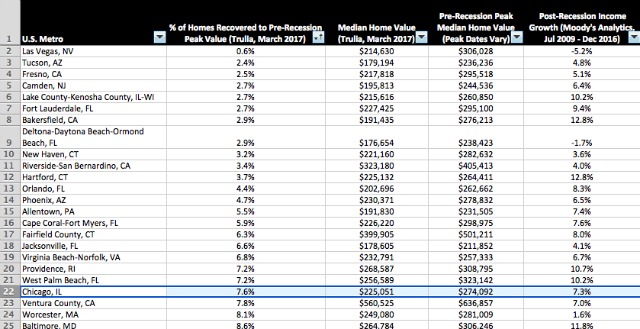

The conventional real-estate wisdom says that the U.S. housing market has for the most part recovered from the recession, at least in terms of individual home values. But a new report says not so fast—especially in Chicago. Nationwide, only 34.3 percent of homes have gone past their pre-recession peak values. In Chicago, that figure plummets even more dramatically, all the way down to 7.6 percent.

According to the report, released Wednesday morning by real estate site Trulia, there's some staggeringly wide fluctuation across the country in terms of value rebounds. The nine lowest-performing cities (including Las Vegas at the bottom, at just 0.6 percent) were all below 3 percent. Meanwhile, at the top, Denver and San Francisco both saw 98 percent of its homes surpass pre-recession peak values.

Unfortunately for sellers, Chicago ranks decidedly closer to the Vegases of the world than the Denvers. Other than Phoenix, our city was the only city among the ten most populous to fall within the bottom 25 of recovery percentage. According to the report, which studied the nations's 100 largest metros, Chicago's most recent median home value, as determined in March by Trulia, is $225,051—nearly $50,000 lower than its peak prior to the economic nosedive, $274,092.

Chicago finds itself in fellow keeping with notoriously hard-hit spots like Camden, N.J.; Bakersfield, CA; and Allentown, PA.

Trulia

Trulia also offers some telling supplemental data as to what might be feeding the noticeable lack of a rebound.

Based on figures between 2009 up through the last year or two, post recession income growth, job growth and population growth in Chicago are all sluggish

Income growth: 7.3 percent

Job growth: 5.8 percent

Population growth: 0.9 percent

(Numbers were based on Moody's, Bureau of Labor & Statistics and U.S. Census data.)

That low job-growth figure is again the worst among major metros and low enough for 22nd worst among all cities. (New York City, at 9.7 percent, comes next, among largest cities.) And that number seems significant. "[W]hile job growth isn’t directly correlated with home value recovery, there is a direct relationship between job growth and income growth, the latter of which is strongly correlated with home value recovery," the authors wrote.

And no one should be surprised by the long-term population stagnancy, given the well-publicized and eminently hot-take-able fact that the Chicago area lost more residents than any other county in the nation last year.

Given those low-performing numbers, it could yet be a long road to higher home values, especially in the city's hardest-hit neighborhoods.

[H/T Crain's]