Paying Through The Nose

By Chuck Sudo in Food on Aug 20, 2007 6:00PM

Having dealt with liquor wholesalers and spirits marketing companies for as long as we have, the past few years have been an interesting time frame. We've seen companies throw insane amounts of money (in some cases overpaying) to acquire high-profile spirits brands for their portfolios. No amount of money spent so far may come close to what Deerfield-based Fortune Brands Inc. may have to shell out in order to maintain the distribution rights to Absolut vodka.

Having dealt with liquor wholesalers and spirits marketing companies for as long as we have, the past few years have been an interesting time frame. We've seen companies throw insane amounts of money (in some cases overpaying) to acquire high-profile spirits brands for their portfolios. No amount of money spent so far may come close to what Deerfield-based Fortune Brands Inc. may have to shell out in order to maintain the distribution rights to Absolut vodka.

Later this year Vin & Sprit, the parent company of Absolut owned by the Swedish government, is set to be sold in a push to privatize many state businesses. Already, Fortune Brands competitors Pernod Ricard, Bacardi Ltd., and Diageo have publicly announced that they plan on making bids for Absolut. The sale could fetch as much as $8 billion if a bidding war breaks out, according to Crain's. It's also possible that even that estimate is low. Beer companies like Anheuser-Busch and private equity firms may also join in the bidding. It's a lot of money for a vodka that isn't our first choice from the back bar.

For Fortune Brands, keeping Absolut in their portfolio is a necessity, as it's their most popular vodka brand. Last year, they acquired the rights to Maker's Mark, Sauza tequila, and Courvosier cognac among 25 wine and spirits brands they purchased from Allied Domecq, and are still paying down the debt accrued from that $5.25 billion deal. The possibility also exists that, should Fortune Brands lose the rights to one of their competitors, they could file an antitrust lawsuit. Pernod Ricard owns Stoli; Diageo owns Smirnoff. Bacardi purchased Grey Goose last year in a then-staggering $2 billion deal, so one can feasibly use that as a baseline for where the bidding on Absolut will start.

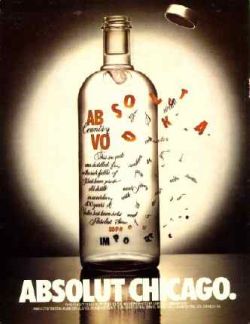

Image courtesy of Absolut Ad.