A State-by-State Look at Tax Increases in a Recession

By Kevin Robinson in News on Jun 23, 2009 7:00PM

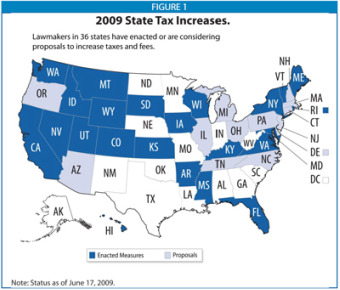

As Illinois's political leadership struggles to close a daunting hole in the state's budget, the debate over raising taxes versus cutting services brought the governor and legislative leaders to a near standstill. The Center on Budget and Policy Priorities posted an interesting analysis of how different states are coping with decreased revenues in the ongoing economic crisis. They found that many states are looking at a combination of both spending cuts and tax increases to balance state budgets. According to their research, 23 states have raised taxes since the beginning of 2009, and 13 more states are considering tax increases.

As Illinois's political leadership struggles to close a daunting hole in the state's budget, the debate over raising taxes versus cutting services brought the governor and legislative leaders to a near standstill. The Center on Budget and Policy Priorities posted an interesting analysis of how different states are coping with decreased revenues in the ongoing economic crisis. They found that many states are looking at a combination of both spending cuts and tax increases to balance state budgets. According to their research, 23 states have raised taxes since the beginning of 2009, and 13 more states are considering tax increases.

The great majority of states have cut services to families and individuals, including services that benefit vulnerable families. But these cuts have not been sufficient to solve state budget shortfalls; their size is too great for a cuts-only strategy. Were states to rely on spending cuts alone to close their gaps, it would require unprecedented reductions in such essential public services as health care, education, and assistance for the elderly and disabled.

The Center goes on to look at the kinds of taxes that states have increased to cope with the budget shortfalls, and then examines the historical effects of tax increases during recessions.

The recession of 2001 hit some states harder than others. As a result, some states raised taxes while others did not. But there is no evidence that tax-raising states were any faster or slower to recover from the recession than those that did not raise taxes. States that raised taxes were just as fast to rebound from the recession as states that did not, even though they were typically climbing out of a deeper hole. North Carolina, for example, raised taxes by about 3.5 percent of revenues during the last downturn. From 2004 to 2007, total personal income in the state grew by about 6.7 percent each year compared to the nationwide rate of 6.2 percent during this period. North Carolina experienced faster-than-average growth in employment following the last recession, growing about 2.5 percent each year from 2004 to 2007. Nationwide, employment grew at an annual rate of 1.7 percent during this period.Similarly, growth in total personal income and employment from 2004 to 2007 exceeded national averages in South Carolina, Virginia, and Washington — all of which enacted significant tax increases during the recession of the early 2000s.

On the other hand, a number of states that did not raise taxes, or cut them, during the last recession subsequently saw slower-than-average economic growth. Among them are Iowa, Kentucky, Minnesota, Missouri, New Hampshire, and Wisconsin. Those states’ decision to avoid tax increases (and, in some cases, to enact large cuts in services) failed to protect them from below-average growth in both personal income and employment during the subsequent period.

In short, neither economic theory nor experience supports the idea that states should shy away from raising taxes in a recession for fear of harming their economic performance.