County Property Tax Bills Held Up Until After General Election

By Staff in News on Sep 30, 2010 4:20PM

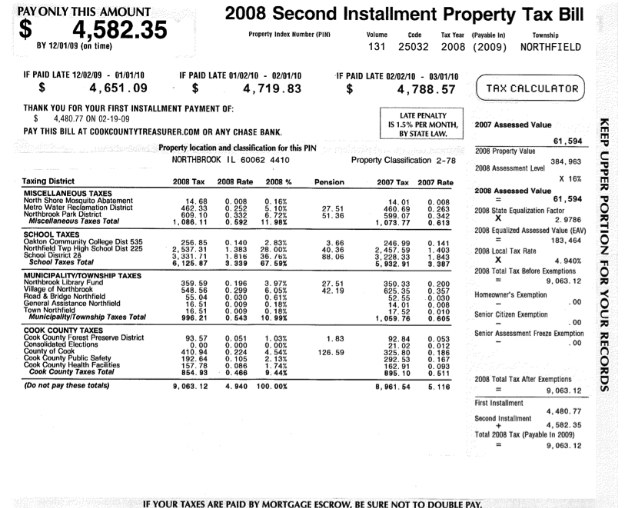

Property owners in Cook County are in for a holiday surprise. Second installment tax bills won't be mailed out until November 22. With a due date of December 22, the bills will be sent out in time for property owners to deduct the taxes from their 2010 income tax returns, but a full month after the general election.

It was expected that the second installment bills would go out late this year; the last time Cook County met the August 1 deadline for sending out second installment bills was 1978. But the combination of a new "10-25" ordinance calling for residential properties to be assessed at 10 percent of their market value, and commercial properties at 25 percent; and a record number of property tax appeals filed with both the County Assessor and County Board of Review ensured they wouldn't meet the deadline this year, either. The Board of Review just completed the last of 436,000 appeals a couple of weeks ago. Maybe they would have finished sooner if Joe Berrios, one of the three commissioners on the Board, hadn't taken a day off for a charity golf outing.

The worst part of the delayed property tax bills is a sharp increase in the county equalization factor, which is used to bring assessments to a legally mandated level. The equalization factor for the second installment bills will be 3.3701, a 113 percent increase over last year.

All this means that property owners will see an increase in their property taxes with the second installments. One could argue that, in an anti-incumbent electoral climate, the last thing the county wants to do to further anger voters is to send out bills right before the election. Start your holiday shopping now, homeowners. You're gonna need to save the money.