Property Taxes Up Sharply in Bear Market

By Chuck Sudo in News on Nov 24, 2010 5:40PM

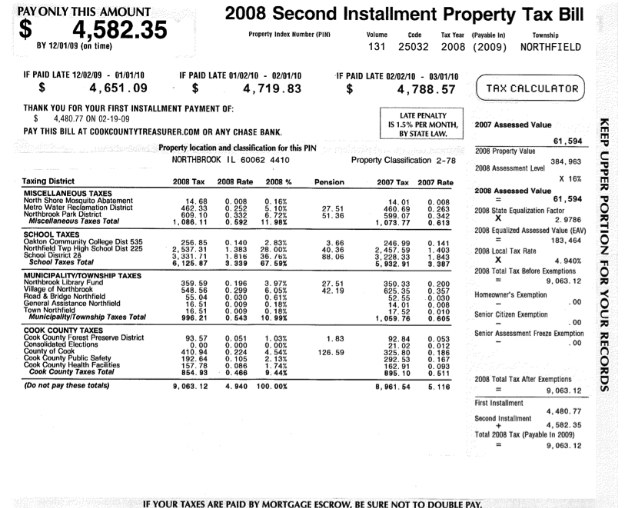

If you're a homeowner in Cook County and saw a sharp increase in your property taxes with your second installment, you're probably wondering how the hell that happened in a depressed housing market. In the city of Chicago, 54 percent of residential property tax bills went up. Before you start tending to your wounds, let's note that the suburbs got hit worse; more than 80 percent of suburban homeowners saw an increase in their second installments. Chances are that if your taxes haven't gone up significantly, you're the exception and not the rule. So why, are you asking, are your property taxes going up now when the value of your home is less than it was three years ago, when the housing market was at the peak of its most recent boom?

The Cook County Assessor's office assesses the various townships in the county on a rotating three-year cycle. Think of it as a course correction for what's happened with market values the previous three years. For Chicago, the triennial reassessment that occurred last year took into account what happened with the rise in market values in 2006 and part of 2007, then the post-boom period of 2007 and 2008. If you were shocked that your assessment went up last year when everyone under the sun (including County Assessor Jim Houlihan, admittedly) knew that the housing market turned into a sinkhole, that's why.

Compounding matters was the passage of a new "10/25" ordinance which changes the rates at which residential and commercial properties are assessed in Cook County. The "10/25" ordinance — which assesses residential properties at a flat ten percent and commercial properties at one-quarter of their market value — is an example of the Assessor's office trying to implement reform so that property owners can better understand how their properties are assessed and how those assessments affect property taxes. Previously, there were six levels of property tax assessment.

Because of the passage of the "10/25" ordinance, all the suburban townships in Cook County received a special reassessment last year, in addition to Chicago's triennial reassessment. This led to record numbers of property tax assessment appeals to both the Assessor's office and the Cook County Board of Review. Neither was ready for the amount of appeals and commensurate outrage at property owners view as an increase in their market values in a recession.

Now, not all is the Assessor's fault, although Houlihan often gets the lion's share of the blame. County and municipal governments still have to function. In order to cover what they spent last year, they increased their tax levies to cover what they're spending. Who pays for those levies? Property owners.

Probably the most significant factor for the increase in your property tax bills is a 113 percent increase in the State Equalization Factor for Cook County, which we referenced back in this September post. The State Equalization Factor is a number determined by the state legislature to ensure that all properties in the county are assessed fairly. In short, Springfield is taking the approach that the county is actually underassessing you. Multiply that factor into a high five-figure or six-figure assessment and you have mortgage escrows ballooning all over the county and homeowners across Cook County underwater on their mortgages.

There are two things you can do to make certain your property taxes are in line. First: Make certain you have every exemption coming to you. You're afforded a homeowners exemption once you live one calendar year in your home. That means, if you moved into your home in November 2008, the clock started ticking for your homeowners exemption on January 1, 2009. To check and see if your exemptions are in place, visit the Cook County Treasurer's website. you can check the status of your exemptions and payment statuses of recent installments simply by keying in your property information number. If you're missing an exemption you think you should have, go to the County Assessor's office and have your installment readjusted.

Second: appeal your assessment when the windows of opportunity are open from the County Assessor or the County Board of Review. This is the only option you have to keep your assessment fair. If you wait until your tax bill is received to want to appeal, you're spitting into the wind. Both the County Assessor's office and the Board of Review set separate filing dates for hearing appeals. Over 80 percent of residential property owners win appeals with the Board of Review every year.