Corporate Income Tax Hike Apparently Not So Bad

By aaroncynic in News on Jul 6, 2011 1:30PM

When the Illinois legislature hiked the corporate income tax rate to 7% for, plenty of businesses shouted and stammered and threatened to leave the state. Businesses paying more money to our financially beleaguered state seemed so outrageous that states like Wisconsin and New Jersey attempted to woo unhappy corporations outside our borders. The Tribune however, found that apparently most businesses aren't having such a hard time with the higher income tax after all.

When the Illinois legislature hiked the corporate income tax rate to 7% for, plenty of businesses shouted and stammered and threatened to leave the state. Businesses paying more money to our financially beleaguered state seemed so outrageous that states like Wisconsin and New Jersey attempted to woo unhappy corporations outside our borders. The Tribune however, found that apparently most businesses aren't having such a hard time with the higher income tax after all.

According to the Trib's examination of public filings, most of Illinois' top corporations paid less than 2% of their earnings in income taxes to states across the country. Some even paid nothing in income tax, or received a refund. Overall, corporate income tax revenues only made up 4.5% of Illinois' general fund revenues in 2010.

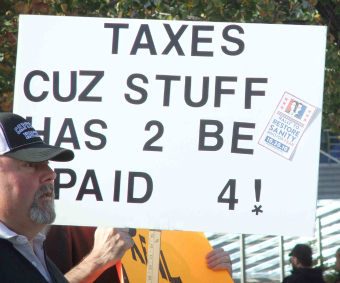

Big companies like Caterpillar and Boeing, who netted $42.6 billion and $64.3 billion in revenue last year, respectively, don't pay much income tax because the bulk of their sales happen either outside the state or the country. Not every company is so lucky, however. A few, such as the CME group, which owns the board of trade, have tax burdens closer to 5% of their earnings. Still, even though Illinois has the third highest state corporate income tax rate, more than two-thirds of corporations pay no income tax to the state. Legislators are planning on putting a panel together to take a look at the disparity. Illinois Senate President John Cullerton and House Speaker Mike Madigan said in an email to the Trib “Critical to our discussions is a review of the disparities that may exist between those businesses that now pay their fair share of taxes and those that do not pay any.”