Property Tax Bills Rising, Sent Out Late As Usual

By Chuck Sudo in News on Sep 19, 2011 2:17PM

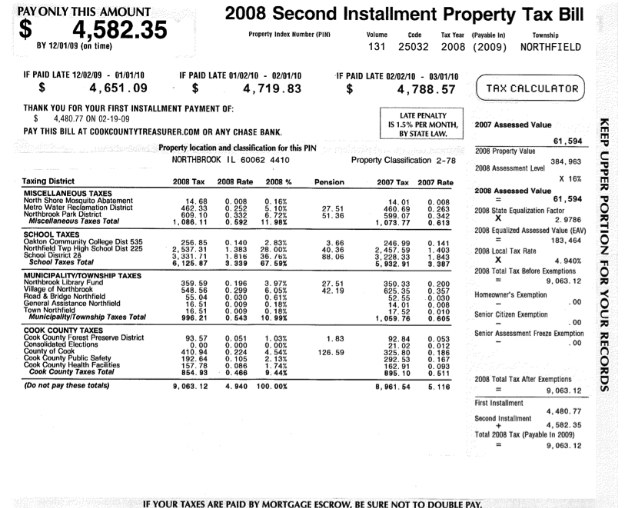

It's that time of year again where we wait for our second installment property tax bills, cursing Cook County and the City all the while.

Cook County Treasurer Maria Pappas announced last week those second installment bills would be sent out the first week in October. Property tax appeals with the County Board of Review were supposed to have been certified in August so the bills could have been calculated sent out this month. The last time that happened was in 1978. Sending the bills out late means some districts may have to borrow money to keep programs afloat until tax payments come back in. Pappas said she's never heard one homeowner complain about the bills being sent out late in her 13 years as County Treasurer.

Meanwhile, property tax bills rose ins the 2009 tax year, according to a new report released by the Civic Federation (PDF). The report also shows Chicago's tax rates is more tax-competitive with the suburbs than it was a decade ago. But the part of the report that will have homeowners flocking to appeal their bills with the County Assessor and Board of Review is seeing their bills rise in a down economy thanks to a combination of lower property values and a rise in tax levies from municipal governments.