State Reps Set To Introduce Bill For $15 Minimum Wage In Illinois

By Stephen Gossett in News on Mar 13, 2017 6:18PM

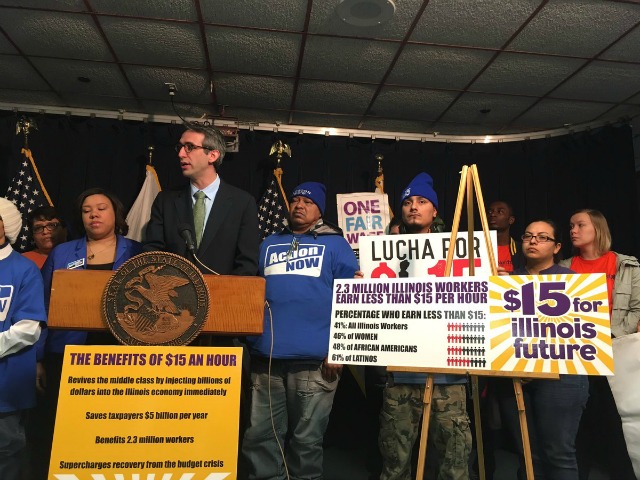

State Rep. Will Guzzardi / Photo: SEIU HCIIMK

The long-percolating battle for a $15 minimum wage in Illinois is heading back to Springfield.

Reps. Will Guzzardi (D-39th) and Litesa Wallace (D-67th) on Monday morning announced a new push to increase the state minimum wage to $15.

"$15 is the only forward for Illinois,” Guzzardi said in a statement. "We need to get Illinois' economy moving again and that begins by putting money in workers' pockets. Guzzardi spoke at a press conference on Monday at the Thompson Center, where he and Wallace were joined by workers from SEIU and representatives from Action Now.

The push for $15 has been brewing for years in Chicago, where the minimum wage stands at $10.50. (The Illinois minimum is $8.25.) Most recently, advocates demonstrated in favor of the raise at an International Women's Day action that also spotlighted charges of workplace abuse. California and New York have made legislative inroads toward a $15 minimum in recent years.

As Crain's points out, Springfield has seen modest steps toward a wage hike, although never as high as $15. Gov. Bruce Rauner and the Democratic-majority Senate have put forth $10 and $11 proposals, respectively. Last year, Rauner vetoed a bill that would have raised the minimum wage to $15 for caregivers of the developmentally disabled. "The bill does not provide any mechanism for funding this additional cost," Rauner said in a statement at the time.

Rauner spokeswoman Eleni Demertzis told Chicagoist via email on Monday, “Gov. Rauner supports raising all wages by making Illinois more competitive through structural changes to grow the economy, create jobs and strengthen our schools.”

The new bill will likely face stiff opposition from groups like the Illinois Retail Merchants Association, who for years have maintained that such a wage hike would push merchants to either slash hours employee hours, raise prices or both. Guzzardi and Wallace hope to ease retailers' anxieties by staggering the wage hike, first to $9 next year then tiering up until 2022, the Tribune reports. Small businesses could also be eligible for a tax credit under the bill to help counterbalance the increase in labor cost.

The pro-$15 group argues that the increase will support workers and also help the state's lagging economy, since low-wage workers would be afforded more income for consumer purchases. The group said that a childless, single worker needs to make $32,500 per year (or $15.63 full time) to "afford the basics."

"You can't get by in this state without $15 and we're going to make sure every employer pays a living wage" @WillGuzzardi #fightfor15 pic.twitter.com/BzI3JyWkFy

— Fight For 15 Chicago (@chifightfor15) March 13, 2017

BREAKING: Rep @WillGuzzardi introduces bill to raise the minimum wage to $15 in Illinois! #15forIL #Fightfor15 #twill pic.twitter.com/d6ecM03IiZ

— SEIU HCIIMK (@SEIUhciimk) March 13, 2017