More People Are Renting, But De-Conversion & Richer Tenants Are Fueling A Terrible Affordability Gap

By Stephen Gossett in News on May 11, 2017 4:20PM

Photo: Stephen Gossett

More and more people are renting, but the amount of affordable housing lags woefully behind. And Chicago's de-conversion-happy ways, coupled with more and more wealthy renters, doesn't help the issue. That's perhaps the biggest takeaway from a new study.

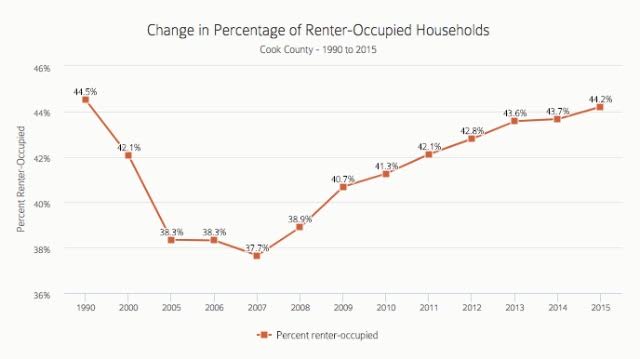

Every year, the Institute for Housing Studies at DePaul University crunches the rental numbers. Looking at figures from 2015, the year for which data was most recently available, researchers found that 44.2 percent of Cook County households come from renters. That number has been steadily rising since 2007 (when the rental rate was 37.7 percent). The 44.2 net is essentially on par with rates from the 1990s—before policymakers, lenders and the housing industry basically started handing out home contracts at the airport, swelling the bubble that burst in 2005.

Institute for Housing Studies at DePaul University

But as rental rates have ticked up, so too has the affordability gap. In Cook County, the supply for affordable housing fell 187,848 units short of demand in 2015. And the overall trend says the divide is growing. The affordability gap has shot up by 30,575 since 2007.

In a neighborhood breakdown, the Loop—where development rages, but rarely to the tune of affordability—is most unforgiving. More than half of the full share demand of affordable housing is not met by the supply. Other neighborhoods with disconcertingly high rates of unmet demand cluster in the tony sectors of the North Side, including Lakeview and Lincoln Park (45.2 percent) and Lincoln Square and North Center (41.8 percent).

The nature of the housing stock itself—and how landlords transform it, and what layouts some renters prefer—doesn't seem to be moving the needle in the right way either. More and more people are renting in singe-family houses and buildings while the iconic two-flat diminishes. "Continuing a trend identified in last year’s State of Rental Housing in Cook County report, the share of rental units in single-family homes and larger multifamily buildings continues to increase, while the share of rental units in two-to-four unit buildings continues to shrink," researchers wrote in the report. In a word: de-conversion—always a very tricky business.

At the same time, basically ever since the rebound from the recession, the overall makeup of renters in Chicago has become increasingly wealthy. The trend is not new. (See Chicago Mag's dive from one year ago.) But it that hasn't shifted.

Researchers explain:

"As the economy improved after 2012, the number of very low-income renter households declined while there were increases in higher-income renter households. This has led to shifts in the composition of renter households by income level. In 2015, this trend is largely unchanged, with moderate increases in renters earning between 30 and 50 percent of the Area Median Income (AMI) as well as increases in renters earning more than 200 percent of AMI".

You don't have to look much further than recent political developments to see that a lot of people get it—whether it's North Side aldermen's recent pledge to add more affordable housing stock, or proposals that would raise fees on stripping a multi-unit residence down to a single-family. Meanwhile, the numbers show that, without course correction actually getting done, the gaps will likely only exacerbate.