Illinois Is Poised To Become The First State To Ever Hit 'Junk' Status

By Stephen Gossett in News on Jun 29, 2017 9:56PM

Getty Images; Photo: Mark Wilson

As awful as it is, Illinois' lack of a budget has been the new normal for two years now. But the state is teetering on the brink of an unprecedented plunge. If no budget is passed by the July 1 deadline (and the outlook doesn't look rosy), Illinois will very likely become the first state to ever see its credit rating fall to "junk" status. And that ignominious distinction would be as bad as it sounds.

Credit rating agency Standard & Poor's earlier this month warned that a "junk" downgrade would be probable if lawmakers don't break the budget impasse by Saturday's session cutoff. That warning came on the heels of the previous blown deadline, which saw S&P ding Illinois to one step ahead of "junk," becoming the worst rated state. Moody's later that same day followed suit.

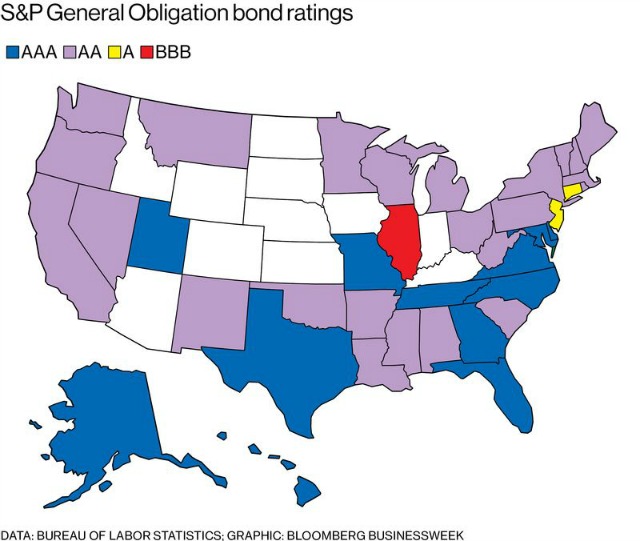

Here's a map via Bloomberg that drives home how just low the state has fallen compared to others. A "junk" rating is literally off the chart.

"The rating actions largely reflect the severe deterioration of Illinois’ fiscal condition, a byproduct of its stalemated budget negotiations," S&P analyst Gabriel Petek said in a statement at the time of the most recent downgrade. “The unrelenting political brinkmanship now poses a threat to the timely payment of the state’s core priority payments."

If the state does indeed hit the "junk" floor, borrowing costs will shoot up, and it becomes that much harder to get out to financial canyon. The state already owes more than $14 billion in unpaid bills and late fees. When it needs to sell bonds, the rate of interest might be in the range of "tens of millions" in a junk situation, Brian Battle, director of Chicago-based investment firm Performance Trust Capital Partners told the AP.

The downgrade would also likely scare off many mutual funds from the state's securities, according to Bloomberg. The jacked-up interest rates that will surely be put forth by investors who might be willing to lend at such a nadir just means even fewer funds to actually direct into the state—whose deep-cut victims include social services, universities, state employees, even the lottery, and, soon enough if the ship isn't righted, Illinois roads.

It's hard to imagine it getting much worse, but it can.